The prices of houses have become a problematic issue for many families in Ireland. The pressure of seeking and maintaining good housing has an impact on the mental health of the nation.

This is even more difficult to manage since they have had past credit problems. They do not provide any help when the banks notice late payments and court judgments. This puts most renters in a bind as they struggle to find ways to pay the deposit.

There are emerging lending options for people with bad credit. Many loans are now able to fill gaps between paychecks at a time when rent is due. These options pay more attention to the current income rather than to past credit.

Online lenders now offer quick decisions for loans for bad credit in Ireland. Many process applications take hours rather than days or weeks.

Why Rent and Housing Costs Are Hard to Manage?

The rent costs are going high across major Irish cities without any sign of slowing down. Many families now spend over half their monthly income on their home. Dublin’s average rent has jumped to €2,400 for a standard two-bedroom flat. Cork and Galway aren’t far behind, with prices rising about 8% yearly.

The upfront costs are even harder to manage. The landlords require one month’s deposit plus the first month’s rent before you receive the keys. This means finding €4,800 upfront in Dublin.

The housing shortage makes everything worse. This crunch lets landlords charge whatever they want, as they know someone or the other will pay. Here are some things that are happening in this situation:

- Utility bills add €200+ monthly on top of rent

- Waiting lists for social housing exceed 5 years in most counties

- Moving costs (vans, time off work) create hidden expenses

- Rental inspections demand constant home upkeep

- Insurance requirements add another yearly cost

Missing rent payments can lead to formal warnings from landlords. The government’s rent control zones help a bit, but don’t solve the problem. Many people turn to credit options when facing housing emergencies.

Loan Options in Ireland for Rent Needs

You need to find quick money when there is a financial crisis. There are many loan options available to individuals with housing expenses they cannot afford.

Short-Term Personal Loans

Banks and credit companies offer personal loans that work well for rent needs. These loans are between €500 and €5000 and have a term of 3 or up to 12 months. Most big banks want good credit scores to approve the loan. The process can take 2-3 days after the form is submitted, and the money will be in your account. The interest rates start around 8% but can reach 15% for bad credit.

Payday Loans

The payday loans provide money within hours. These microloans are between €100 and €1,000 over a period of 1-4 weeks. The speed comes with much higher costs, like 15-25% of what you borrow. Many payday lenders examine whether or not you have a stable job as opposed to a flawless credit score. They tend to transfer money to your bank account on the same day of application.

Credit Union Options

Members can borrow €1,000 to €10,000 with rates much lower than banks. Most unions offer special rent loan schemes that offer flexible terms of payment. You have to be a member before applying, and that can be done in one visit.

Online Lending Platforms

These sites connect borrowers with multiple lenders through one form. The whole procedure is carried out online without using any paper or branch visits. They review your information in a few minutes and transfer money the following day. You get instant approval loans with these lenders.

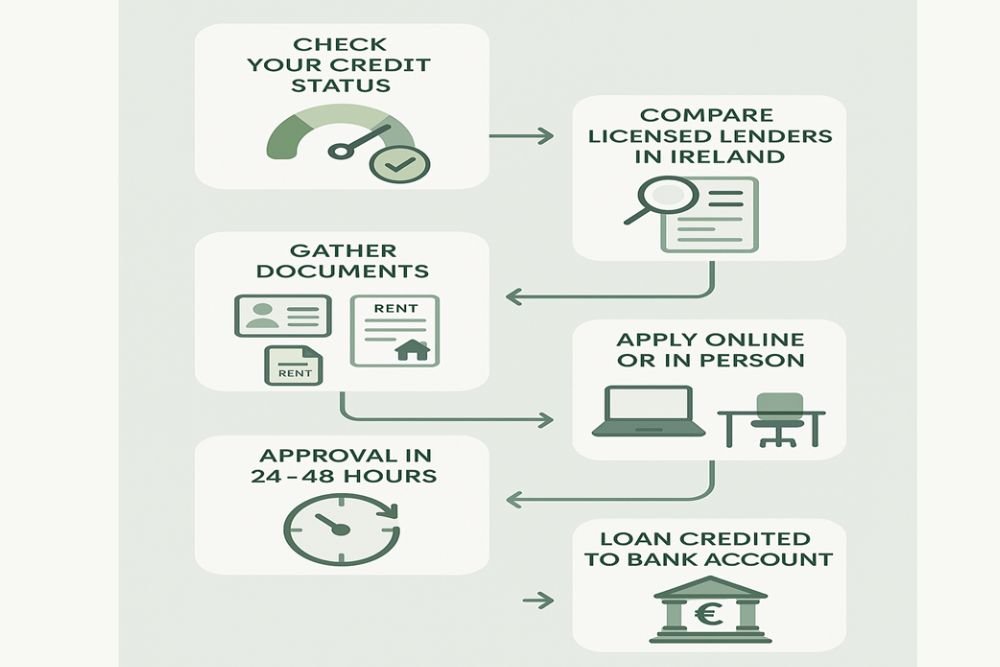

You should know how to apply for bad credit loans. Here is the process to get loans:

Emergency Personal Loans for Deposit Payments

Moving homes in Ireland means finding cash for deposits fast. Most landlords want at least one month’s rent before giving up the rented house. This sum often reaches €1,500 to €3,000 in bigger cities.

Many direct lenders in Ireland specialise in tough credit cases. They check income proof rather than perfect credit scores. The application takes minutes online with basic work and address details. Most ask for three months of bank statements and recent pay slips.

Personal loans for bad credit help when banks say no. These loans focus less on past money troubles and more on your current job status. Many lenders now offer special deposit loans for renters. They understand the housing crunch makes quick money necessary.

Many lenders promise decisions within 60 minutes for deposit needs. Once approved, the money hits your account that same day. Some even offer morning approval with afternoon bank transfers.

Some lenders cap these emergency loans at €2,000 for first-time users. These loans provide a lifeline when moving becomes urgent.

| Alternatives to Loans for Rent Support | ||

| Alternative Option | How It Helps | Suitable For |

| HAP Scheme | Rent partially covered | Low-income tenants |

| Rent Supplement | Temporary shortfall aid | Unemployed/short-term crisis |

| Family Help | No interest borrowing | Short-term rent gaps |

| Credit Union Budget Loan | Low APR flexible loan | Community members |

| Talk with Landlord | Payment extension | Tenants with trust |

Government Help Schemes for Rent Support

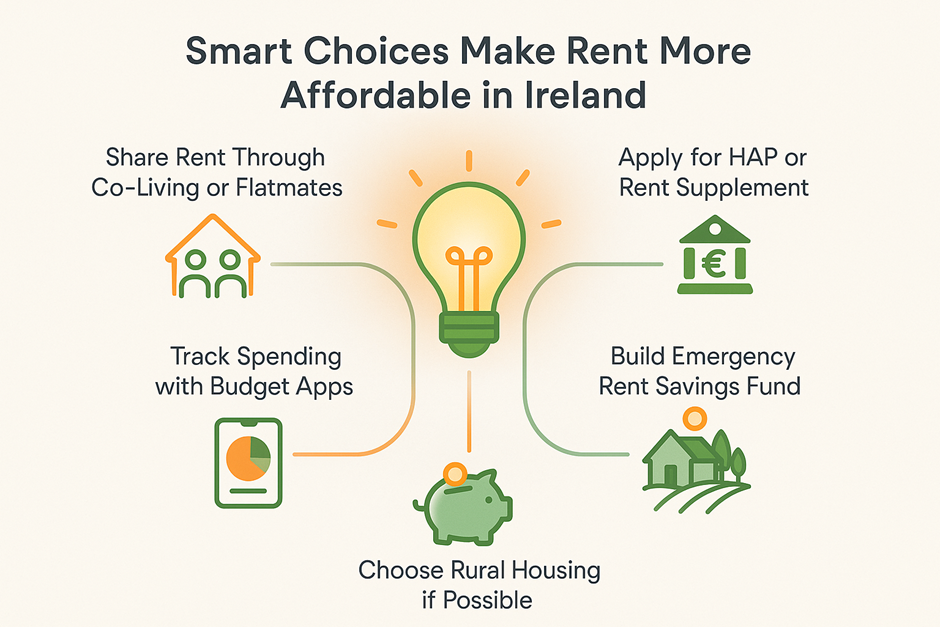

Many renters should also explore government help programs. The state offers several schemes aimed at easing housing costs for those struggling. Some work best for short-term problems while others suit ongoing support. The right one depends on your income, family size, and housing status.

Available Rent Support Programs:

- Housing Assistance Payment (HAP)

- Rent Supplement

- Rental Accommodation Scheme (RAS)

- Cost Rental Housing

- Mortgage to Rent

- Local Authority Housing

- Enhanced Leasing Scheme

The HAP program helps working families with steady but low incomes. It pays part of your rent directly to landlords each month. You then pay a smaller share based on what you earn. Most contribute between €30 and €100 weekly toward their housing.

Rent Supplement is for those facing sudden income drops. It bridges gaps during job loss or after relationship breakdowns. This quick help lasts until your situation improves.

The local councils manage social housing for longer-term needs. The waiting lists stretch years in popular areas, but priority cases move faster. The rent in these homes is fixed at about 15% of your total income. A single person in Dublin must earn under €35,000 yearly to qualify. The limits rise for each child or adult in your household.

Most schemes need proof of housing needs and income details. The forms ask about savings, jobs, and why you need help.

Conclusion

The housing money help with bad credit takes work, but it isn’t impossible. Many government programs offer the cheapest help, but they may work too slowly for urgent cases. The loans should be last-choice options after exploring all other paths. You need to compare rates from several sources before signing.

Riagan Maker is a financial writer and author who always remains dedicated to writing research-based and solution-oriented articles and blogs. He recently joined Liteloans4u 6 months ago, but he possesses very good experience working with top financial companies in the UK. If you want to know what Riagan Maker can do, read the blogs he has written for Liteloans4u. Any loan aspirant can understand the loan products by reading Riagan’s blogs. To prove his knowledge, Riagan Maker has PhD in Business Finance as his top educational qualification.